The most extensive markets for ETFs are in Europe, Japan, Hong Kong and North America. As of October 2002, there are 274 ETFs listed on exchanges around the world. Some of the most popular ETFs are known are the “Spiders”, “the Qubes or Qs,” “Diamonds”, “iShares or iUnits,” “IndExchange trackers” “LDRS (Listed Diversified Return Securities pronounced LEADERS) , MasterShares and Fresco Index Shares”. Each month, more exchanges introduce ETFs as despite the downturn in equity markets, ETFs continue to increase in trading volume and assets under management. Increasingly, ETFs are cross-listed across countries. Europe has the most extensive cross-listed ETF marketplace followed by Singapore (SGX). According to Morgan Stanley, there are 116 ETF listed in Europe with approximately 183 cross-listed. In the US, while ETFs are not formally cross-listed as in Europe, many are traded across exchanges under unlisted trading privileges provisions. The American Stock Exchange, the New York Stock Exchange and Archipalego have extensive ETF trading sections and firms making markets in ETFs. The Chicago Board of Options and NASDAQ also list and trade ETFs.

These products are not to be confused with Exchange Traded Baskets (ETBs) which are “grantor trusts”. ETBs are currently branded by Merrill Lynch as HOLDRs (pronounced “holders”). There are currently 17 HOLDRs listed in the US on the American Stock Exchange.

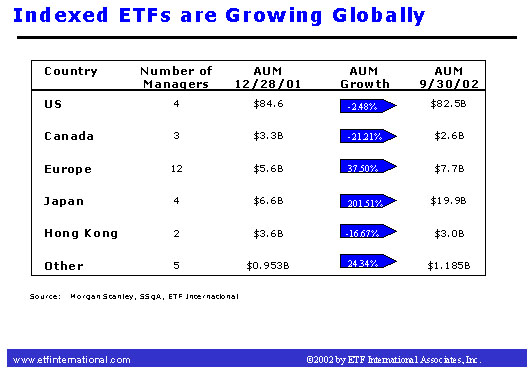

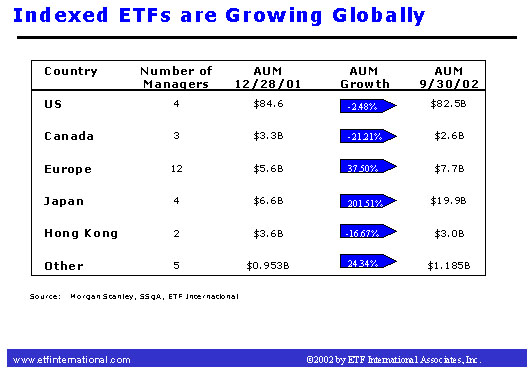

The chart below shows how indexed-based ETFs (IB-ETFs) are a fast growing part of the investment management industry.

Both retail and institutional investors invest and trade ETFs. Indexed-Based Equity and Fixed Income ETFs (IB and FI-ETFs) are the most common and popular ETFs. DWS has sponsored actively managed ETFs in Germany. Enhanced indexed ETFs will soon be introduced in the US market.

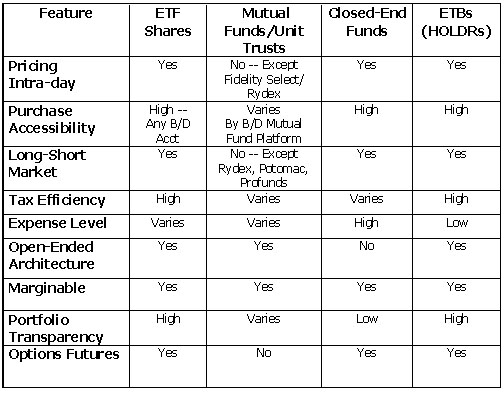

Why are ETFs so popular? ETFs are an attractive alternative replacing to mutual funds and closed-end funds as investment vehicles because they offer superior product architecture and value. ETFs offer the ability to be traded real-time like a stock, marginability, accessibility to investors with brokerage accounts and the transparency of the investment instrument. ETFs can also be more tax efficient and cost efficient compared to a traditional mutual fund. ETFs offer investors and financial advisors more control over their investment funds. See the table below to compare features of ETFs to other popular investment vehicles:

ETF.Com, Inc.

375 South End

Avenue Suite 28J

New York, NY

10280

Phone: 212.465.3352

email: info@exchangetradedfunds.com