| Is

the exchange-traded fund market in Europe getting overcrowded? Some observers

contend there are already

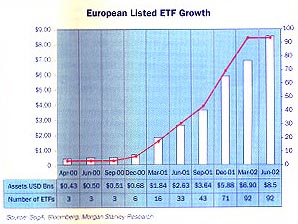

too many ETFs, while others argue there is plenty of room to grow, both fund-wise and asset wise. To be sure, the growth in sheer number of funds is impressive. In July, the head count of European-listed exchange traded funds surged to 106 versus 71 at the end of 2001, and surpassing 102 US-listed ETFs, according to Morgan Stanley & Co. But a fair number |

of

the European funds are cross-listings of the same product, and assets only

amount to $8.5 billion, a fraction of the $90.1 billion in US-listed ETFs.

That only encourages the growth advocates, who contend that it proves there

is more to go in Europe.

In any case, there is plenty of action. At the Boursa Italiana, an ETE based on the new S&P MIB 45 that tracks major companies on the Milan Stock Exchange is scheduled for launch by year's end. Standard & Poor’s has been called in |

| So what

sort of reception can these new ETFs expect?

Recent history suggests that it can be unpredictable. |

|

|

to

help the Boursa revamp revamp the former MIB 30 benchmark, which was relatively

illiquid and included companies with significant government ownership,

replacing it with the broader MIB 45 that incorporates S&P methodology

like float adjustments. Bob Shakotko, managing director of S&P’s index

services, says its role will continue as a participant in the selection

of licensees for the index.

Other index groups and exchanges have hardly been idle. Over on the Amsterdam-based Euronext, a flurry of requests for proposals is out, including the first real estate ETFs, one to follow the existing EPRA Europe index which tracks 75 publicly quoted European property stocks, and a second, which will track the new EPRA Europe Liquid Blue Chip index, a subset that contains only the highest turnover or largest market capitalisation stocks. |

| Dow-Jones,

whose widely followed EuroStoxx 50, and Stoxx 50 indexes and ETFs have

attained benchmark status, is not about to be left behind. In July, IndEXchange,

the dominant German ETF issuer, launched 14 new funds replicating the Dow

600 sectors on the Deutsche Boerse. “And we’ll see more global sector Titans,

and country Titans,” says Lars Hamich, senior director Dow's global index

operations.

“What we want to do with the country Titans is give providers who didn’t get a license for, say, the DAX or the CAC 40, an opportunity to complete their family," he explains. “We already did that last year with the UK Titans.” Last, but not least, from the US will come the QQQs, the hugely popular ETF that tracks the Nasdaq 100. The EQ, as the European-listed version is already being called, will be a UCIT, and was still working its way through the Dublin regula tors in mid-summer, but expected to make an October launch on Nasdaq Europe, the Brussells-based electronic exchange. |

|

| Not every player is racing to roll out new products though. John Demaine, director of ishares at Barclays Global Investors, takes a more measured view, even though some are watching to see what BGI will do in Europe, now that it has launched the first bond ETF in the US. But any | European-listed bond product is likely to be based on European indices, and “still a little way off”, says Mr. Demaine. “We’re certainly looking at it, but we are also expecting to learn from the US experience.” That said, he indicates that BGI, too, will have some new products late this year. |

| Even though

competition is heating up,

don’t expect any ETFs to disappear soon. |

|

| So

what sort of reception can these new ETFs expect? Recent history suggests

that it can be unpredictable, especially when stock markets are turbulent.

BGI’s i-shares S&P 500, launched in March, is going in the “right direction”,

says Mr. Demaine, although he suggests that the volatile US market has

probably slowed the process.

On the other hand, Credit Lyonnais Asset Management, a brand new player, has hit the ground running with the SPDR 350, which tracks 350 pan-European companies in ten sectors, and its subset, the SPDR Euro, which covers only EU companies. The French manager has targeted the institutional market, and assets in the two funds rose quickly to just over $500 million in July, placing it in the top ten asset-wise after only seven months. “We’ve staked out a different part of the turf,” says Mr. Shakotko of S&P, explaining the reasons for the 350’s success. “People preferred narrower market indicators originally, like the Stoxx indices, but now they’re saying broader is better.” |

Deutsche Boerse-the leader in Europe |

| An

interesting sidelight to the 350 launch was S&P’s selection of Credit

Lyonnais to manage its SPDRs in

Europe, reportedly in part because of a branding issue. The 350 is managed by BGI in the US, but “it’s pretty common knowledge in the industry that S&P wanted to take the SPDRs to Europe without the Barclays ‘i-shares’ tacked on, as it is in the US” says one observer. “S&P’s goals conflicted with Barclays.” Meanwhile, flush with success, Credit Lynnais is already looking ahead. “This alliance is bound to bring more fruit,” says Mark Sinsheimer, executive vice president and head of business development. “You can dice the 350 in many ways, by countries, style, and sectors, all based on its sub-segments.” But there is no doubt that as ETFs proliferate, competition is intensifying. A case in point is AXA Investment Managers, the French provider, whose EasyETFs sported far highert fees than those of its competitors. In June, it slashed the total expense ratio to 0.45 percent on of its funds, making them the lowest cost products for European exposure. For some of ETFs, that was a cut of more than 50 percent. Even though competition is heating up, don't expect any ETFs to disappear soon. “Europe is fragmented,” observes Mr. Demaine. “If you're an Italian, it’s still easier to buy in Italy. Clearly there are a lot of funds out there, but someone made the reasonably insightful comment that normally an efficient market means that the sub-scale ones would be removed, but because of fragmentation, it will take longer.” |

Indeed,

a look at ETF trading volumes on various exchanges is informative in many

ways. According to data from Morgan Stanley, as of April the Deutsche

Boerse was far and away number one, with roughly 58 percent, followedd

by Euronext with 35 percent. From there, the volumes shrink dramatically,

to about 3 percent each on the London and Swiss stock exchanges,

and even less on bourses in Helsinki and Stockholm, which have only a few

listed ETFs.

Nevertheless, more exchanges are throwing their hats in the ring. With the launch of the ETF for the S&P/MIB45, the Milan Stock Exchange will become the ninth venue. What’s more, the Italians are successfully soliciting other listings. Credit Lyonnais, Merrill Lynch, Societe Generale and UNICO, the German group, are already on board. Electronic exchanges are also rolling out the welcome mat. London-based Virt-X, owned by Swiss Stock Exchange and a consortium of Swiss banks, began trading 23 listings from issuers including BGI and Merrill in May, offering them a choice of currency. BGI, for example, trades its i-shares S&P 500 in sterling on the London Stock Exchange, and in US dollars on Virt-X. Virt-X aims to lure customers with cheaper trading in European blue chips, but so the year-old venture has traded mostly Swiss stocks. In July, it announced that it had fallen short of its goal of taking 10 percent of cross-border trading, achieving only 9.2 percent. But nowhere are the fortunes of an exchange and an ETF more closely linked than with Nasdaq’s ventures in Europe. The EQ, which tracks the NASDAQ 100, will launch on Nasdaq Europe |

| But nowhere

are the fortunes of an exchange and an ETF more

closely linked than with Nasdaq’s ventures in Europe. |

|

Michael Sanderson |

in

early October, just as soon as SuperMontage, Nasdaq’s new electronic trading

platform, is up and running. Once trading is underway, investors will also

be able to buy the EQ through the main European stock exchanges."We decided

early on that we wanted as wide a participation as possible,” says Mike

Sanderson, chief executive of Nasdaq Europe.

Nasdaq is betting on the tech-heavy EQ and SuperMontage, which it says is lower cost and more efficient, to boost the venture, which has gotten off to a slow start because of volatile US markets. Mr. Sanderson said he plans to solicit other ETF listings as well. But it’s a safe bet that market watchers will be focused on a more ambitious venture, Nasdaq Deutschland, as it takes on the dominant Deutsche Boerse early next year. As with Brussells, Nasdaq’s German venture will list US and European equities, and ETFs, anchored by the EQ. Nasdaq hopes to succeed where others have failed: to tap the lucrative German market. It has some important partners, namely Commerzbank and its on-line unit, ComDirect, and Dresdner Bank, who are said to be frustrated by the Deutsche Boerse’s grip on pricing and near monopoly on trading in Germany. The Bremen and Berlin stock exchanges, which cater to private investors, also have stakes, and Mr. Sanderson says he will target these customers as well. Meanwhile, the Deutsche Boerse fields 57 ETF’s, including the 14 new Dow Jones funds, more than any other exchange. “And we have the liquidity,” says Candice Adam, a spokeswoman, noting that each ETF has two market makers and access to an “enormous network” of traders, plus an array of allied products like options on ETFs. Mr. Sanderson says that Nasdaq is up to the challenge, and that its SuperMontage electronic trading platform will add allure. “I know it’s going to take a while,” he says. “I’ve been in the business 30 years so I have no illusions, but if we can offer a more efficient platform and cheaper execution over time, we will gain a respectable market share.” |